Compound interest calculator with annual contributions

R the compound interest rate. How to Grow Your Investments With Compound Interest.

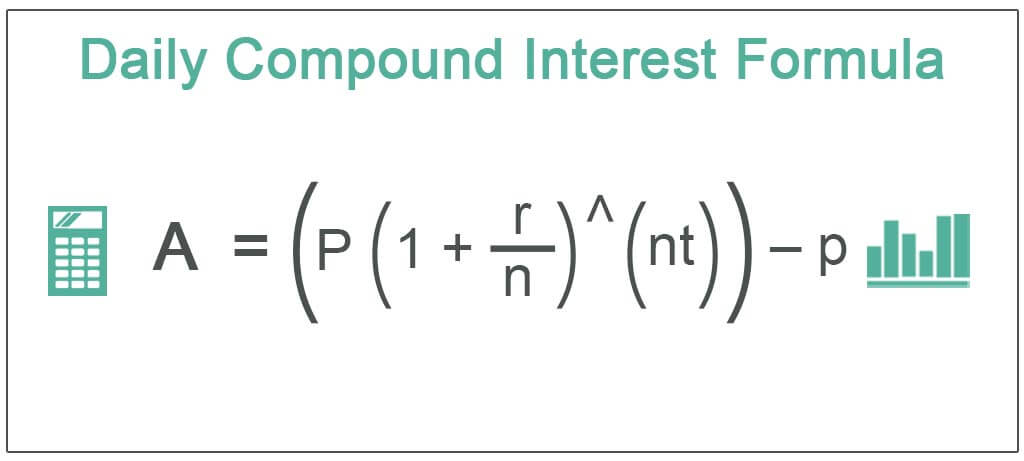

Daily Compound Interest Formula Step By Step Examples Calculation

Mortgage Loan Auto Loan Interest Payment Retirement.

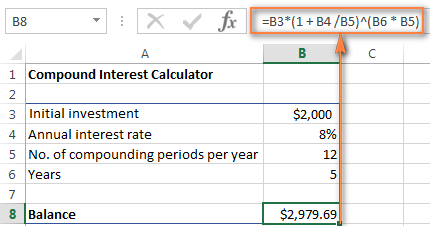

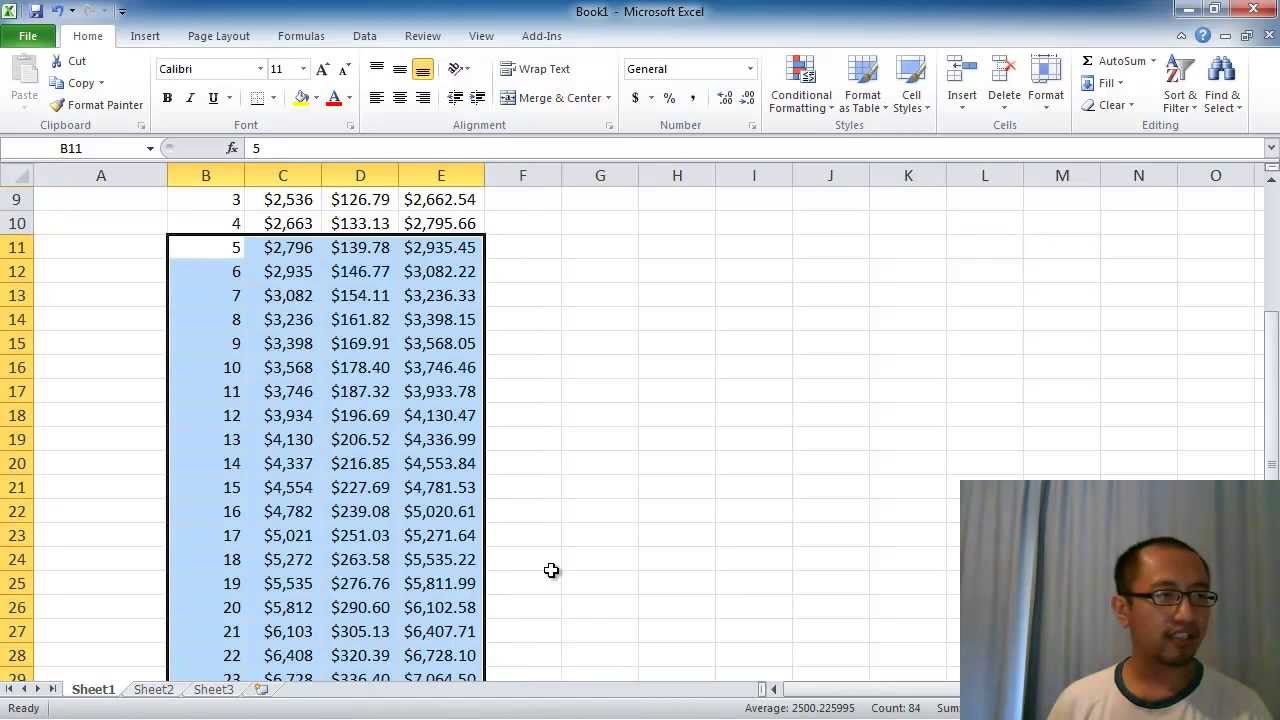

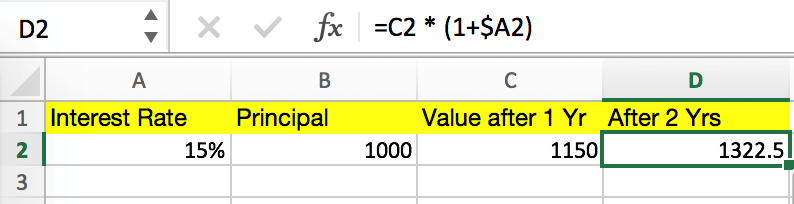

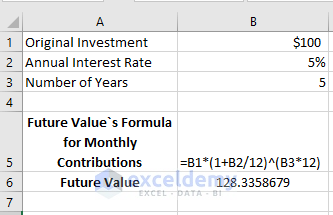

. The Power of Compound Interest Calculator. As you may remember we deposited 2000 for 5 years into a savings account at 8 annual interest rate compounded. In the meantime lets build a FV formula using the same source data as in monthly compound interest example and see whether we get the same result.

You can find many of these calculators online. A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts. Interest paid in year 1 would be 60 1000 multiplied by 6 60.

Even when people use the everyday word interest they are usually referring to interest that compounds. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan. The Principle of Compound Interest.

For instance lets say year one you invest 1 of your gross salary. We change from annual contributions and compounding to monthly. After another month the interest of 1 calculated from your 101 deposit will be 101 so the money you now have in the bank are 10201.

Determine how much your money can grow using the power of compound interest. The annual interest rate that matches your compounding frequency. That means your new deposit is 101.

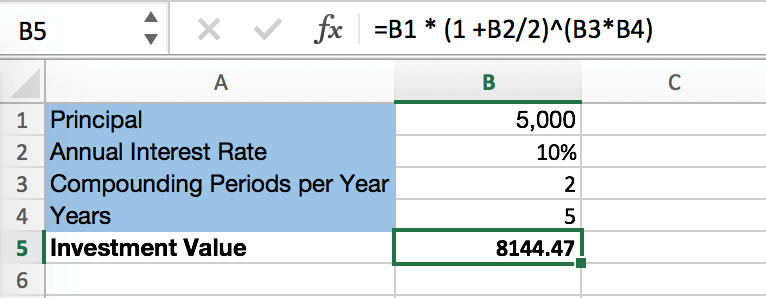

The detailed explanation of the arguments can be found in the Excel FV function tutorial. Include additions contributions to the initial deposit or investment for a more detailed calculation. Weve got a compound interest calculator that will do the calculations for you.

But its power is undeniable and simpler than it seems. For instance many savings accounts quote an annual rate yet compound interest monthly. You neednt worry though the sinking fund calculator will do that for you just put your annual interest rate into the tool.

In finance and economics the nominal interest rate or nominal rate of interest is either of two distinct things. Your estimated annual interest rate. Increase your contributions instead of increasing your standard of living.

Adjust the lump sum payment regular contribution figures term and annual interest rate. T the number of periods the money is invested for. Assume that you own a 1000 6 savings bond issued by the US Treasury.

If youd like. Compounding interest requires more than one period so lets go back to the example of Derek borrowing 100 from the bank for two years at a 10 interest rate. You earn interest on top of interest.

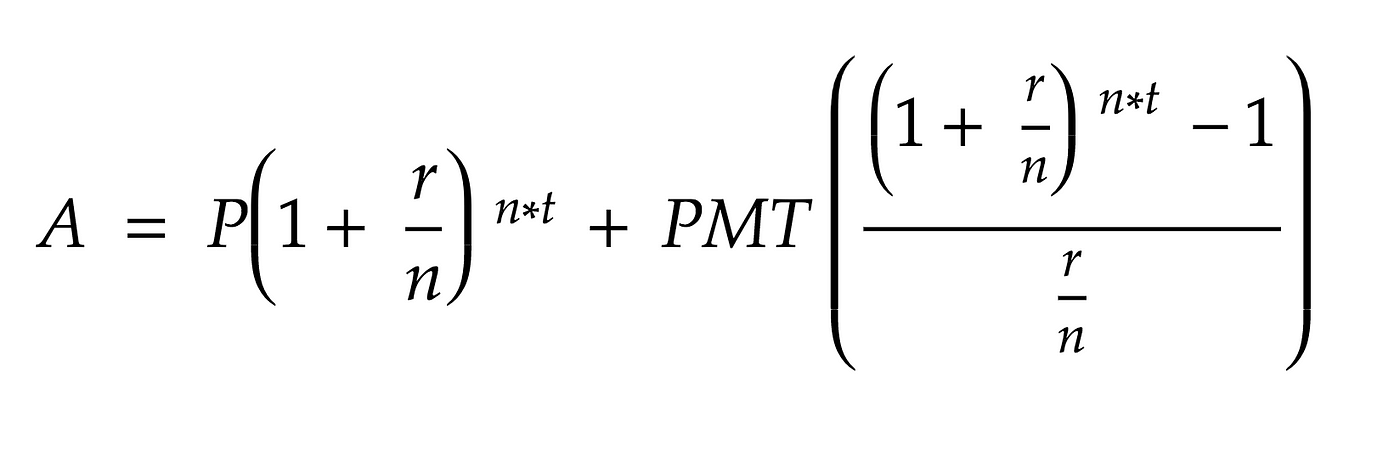

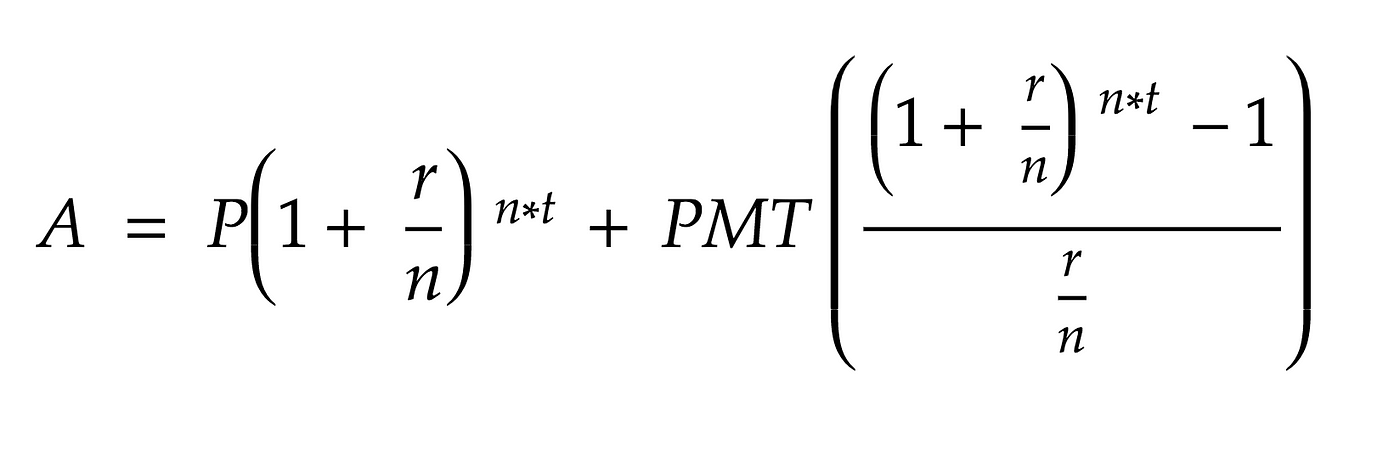

The other parameters stay the same. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match.

Put Inputs Here. N the number of times that interest is compounded per period. Years Percent Yield Initial Balance Monthly Contribution Results.

Interest rate variance range. Plus you can also program a daily compound interest calculator Excel formula for offline use. See how much you can save in 5 10 15 25 etc.

Compound Annual Growth Rate CAGR. The interest can be compounded annually semiannually quarterly monthly or daily. A compound interest calculator is a simple way to estimate how your money will grow if you continue saving money in savings accounts.

Plus it allows you to add monthly contributions. Savings Calculator This one takes a lump sum of money and compounds it monthly over a fixed period of time at a fixed annual yield. Range of interest rates above and below the rate set above that you desire to see results for.

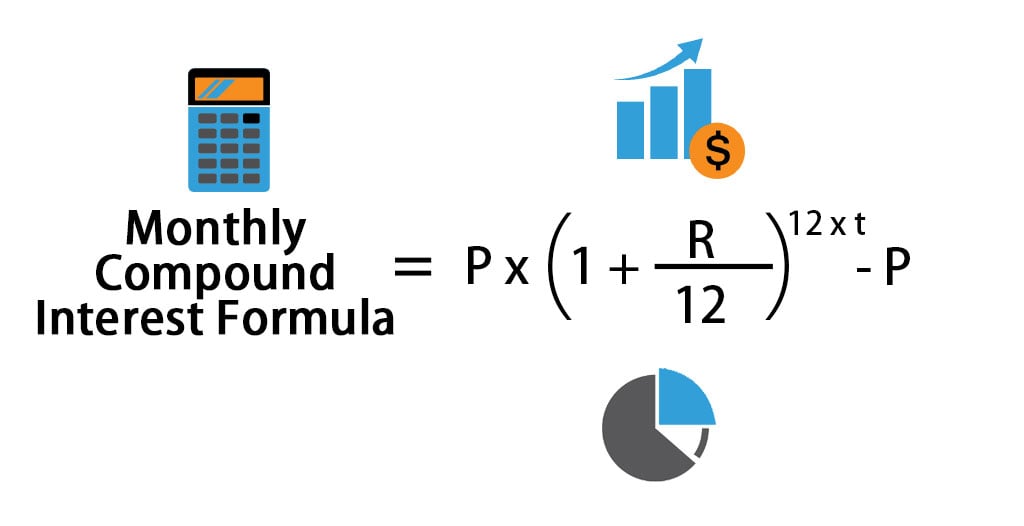

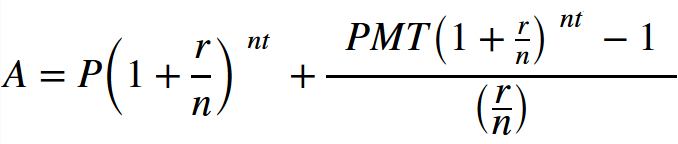

Or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. For example if your annual interest rate is 6 and interests are compounded monthly you should use 612 05. Compound interest can be a difficult concept for adults let alone kids to grasp.

Treasury savings bonds pay out interest each year based on their interest rate and current value. For interest rates as stated without adjustment for the full effect of compounding also referred to as the nominal annual rateAn interest rate is called nominal if. However simple interest is very seldom used in the real world.

Annual contributions to an employees account cannot exceed the lesser of 100 of the participants compensation or 61000 in 2022. Years at a given interest. Your money earns interest every day if it compounds daily and then the next days interest is calculated based on THAT total instead of on the principal.

To calculate interest with regular contributions begin with the accumulated savings formula and input your. If people begin making regular investment contributions early on in their lives they can see significant growth in their savings value further down the road as their interest snowball gets larger and they. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance.

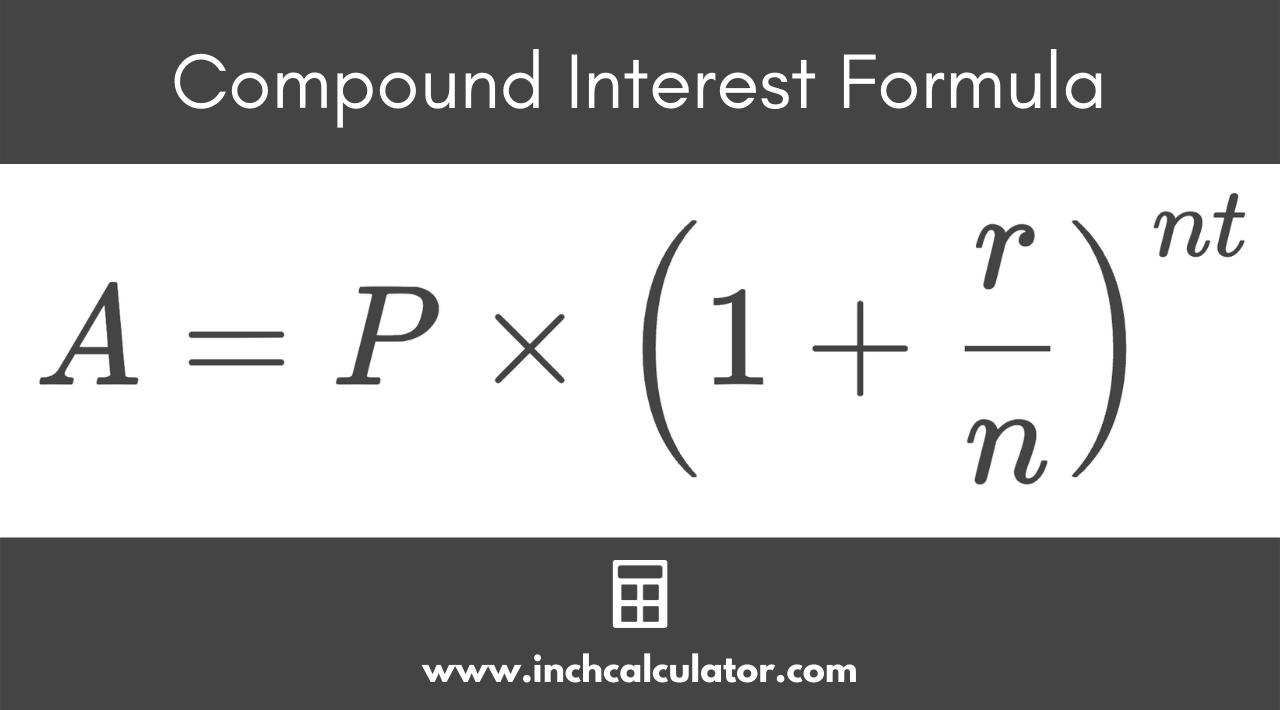

The compound interest formula used in the compound interest calculator is. You should invest at least 15 of your income in retirement. The rate of interest before adjustment for inflation in contrast with the real interest rate.

P the principal investment amount. Thats a few dollars higher than the annual compound interest example. In comparison to the simple linear interest with the compound interest your money increases at an exponential rate which means a more rapid way of growth for your account.

This is a compound interest calculator savers can use to get an idea of how. A P1rnnt A the future value of the investment. Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest.

Use of a continuous compound interest calculator is among the various benefits of this strategy is the fact that it allows you to visualize investment horizons. Just click the compound interest table on the right and youll see each year your starting balance your annual contributions cumulative contributions interest earned. Estimate the total future value of an initial investment or principal of a bank deposit and a compound interest rate.

Annual Contributions Cumulative Contributions Interest Earned Cumulative Interest Total Balance. I am looking for a calculator that increases the contribution to a 457 account annually. Calculate interest compounding annually for year one.

The power of compound interest means you earn interest on interest. Each month a fraction of the annual interest is calculated and added to your balance which in turn affects the following months calculation.

Compound Interest Formula And Calculator For Excel

Compound Interest Definition Formula How It S Calculated

Compound Interest Formula And Financial Calculator Excel Template

A Story About A Graph Part 1 How To Make A Compounded Interests With By Diogo Batista Medium

Microsoft Excel Lesson 2 Compound Interest Calculator Absolute Referencing Fill Down Youtube

Compound Interest Calculator Inch Calculator

Monthly Interest Calculator Discount 54 Off Www Wtashows Com

Compound Interest Formula In Excel And Google Sheets Automate Excel

Walletburst Compound Interest Calculator With Monthly Contributions

Compound Interest Formula In Excel And Google Sheets Automate Excel

How To Work Out Compound Interest On Savings 14 Steps

Compound Interest Calculator For Excel

Compound Interest Formula And Calculator For Excel

How To Calculate Compound Interest Quora

How To Use Compound Interest Formula In Excel Exceldemy

Compound Interest With Monthly Contributions Calculator Formula

Compound Interest Formula And Excel Calculator The Investment Mania